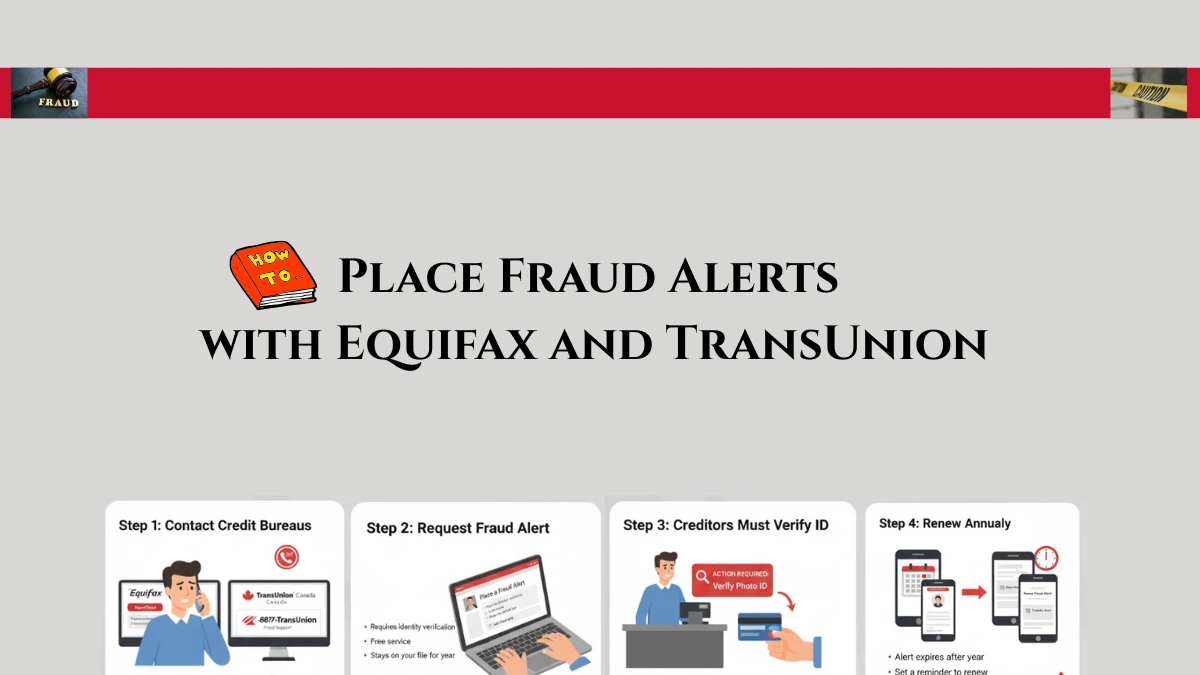

Identity theft and credit fraud are serious concerns for consumers, and placing a fraud alert on your credit report with Canada’s leading credit bureaus Equifax and TransUnion is an important step to protect yourself.

A fraud alert warns potential creditors to verify your identity before granting new credit, reducing the risk of fraudulent accounts opened in your name.

This comprehensive guide explains how to request a fraud alert with both Equifax and TransUnion in Canada.

What is a Fraud Alert?

A fraud alert is a notice placed on your credit reports to alert lenders and businesses that your personal information may be compromised.

When a fraud alert is active, creditors must take extra precautions, such as contacting you directly, before issuing credit under your name.

How to Place a Fraud Alert with Equifax Canada

- Visit the Official Equifax Canada Fraud Alert Page

Navigate to Equifax Canada’s secure fraud alert webpage: consumer.equifax.ca/personal/credit-report/fraud-alert/ - Begin Your Fraud Alert Request

Whether or not you have an online Equifax account, you can proceed to request a fraud alert by following the step-by-step instructions provided. - Submit Required Personal Information

To place the fraud alert, provide your full legal name, date of birth, current address, Social Insurance Number (SIN), and other requested identification details to verify your identity. - Specify Alert Duration

Standard fraud alerts typically last for 90 days but can be renewed or extended based on your preferences or risk level. - Confirm and Submit Your Request

Review the information carefully and submit your fraud alert request. Equifax will place the alert on your credit file and notify creditors. - Utilize Credit Monitoring Resources

Equifax often provides access to credit monitoring services or instructions on how to review your credit report regularly to detect potential fraudulent activity.

Step-by-Step Guide to Place a Fraud Alert with TransUnion Canada

- Access the TransUnion Fraud Alert Portal

Visit TransUnion Canada’s official fraud alert page at https://www.transunion.ca/fraud-alert - Provide Your Identity Details

Enter your full name, date of birth, SIN, and address as part of the identity verification process for fraud alert placement. - Submit the Fraud Alert Request

You may place a fraud alert online or call TransUnion’s toll-free number at 1-800-663-9980 to complete the request by phone. - Validate Your Identity

In some cases, TransUnion may require additional documents to verify your identity for security purposes. - Understand Alert Duration and Extensions

Like Equifax, the fraud alert typically lasts 90 days, with options available to extend based on your situation. - Review Credit and Monitor for Fraud

Stay vigilant by obtaining your credit reports and monitoring for unauthorized inquiries or new accounts. TransUnion provides tips and resources for ongoing protection.

Why to Place Fraud Alerts?

- Extra Security on Credit Applications: Lenders must contact you to verify your identity before granting credit, reducing unauthorized credit approvals.

- Easy to Implement and Free of Charge: Fraud alerts can be placed without cost, usually activated quickly after your request.

- Temporary but Renewable: Alerts last 90 days, offering flexibility depending on your exposure to risk.

Additional Protective Actions on Fraud Alerts

- Credit Freeze or Lock: For stronger protection, consider freezing your credit files, which restricts access altogether.

- Report Identity Theft to Authorities: File a police report and notify the Canadian Anti-Fraud Centre if you are a victim of identity theft.

- Monitor Your Financial Statements: Regularly check bank and card statements for suspicious transactions.

Conclusion: Placing fraud alerts with both Equifax and TransUnion is a crucial and proactive measure to protect your Canadian credit profile from identity theft and fraud.

By following the step-by-step instructions provided by each bureau, you can ensure creditors take extra steps in verifying your identity, safeguarding your financial health. Regular monitoring and additional security measures complement these alerts for comprehensive protection.